Returns are always a hot topic in January with the rush post-Christmas and they come with no surprise as an expensive cost.

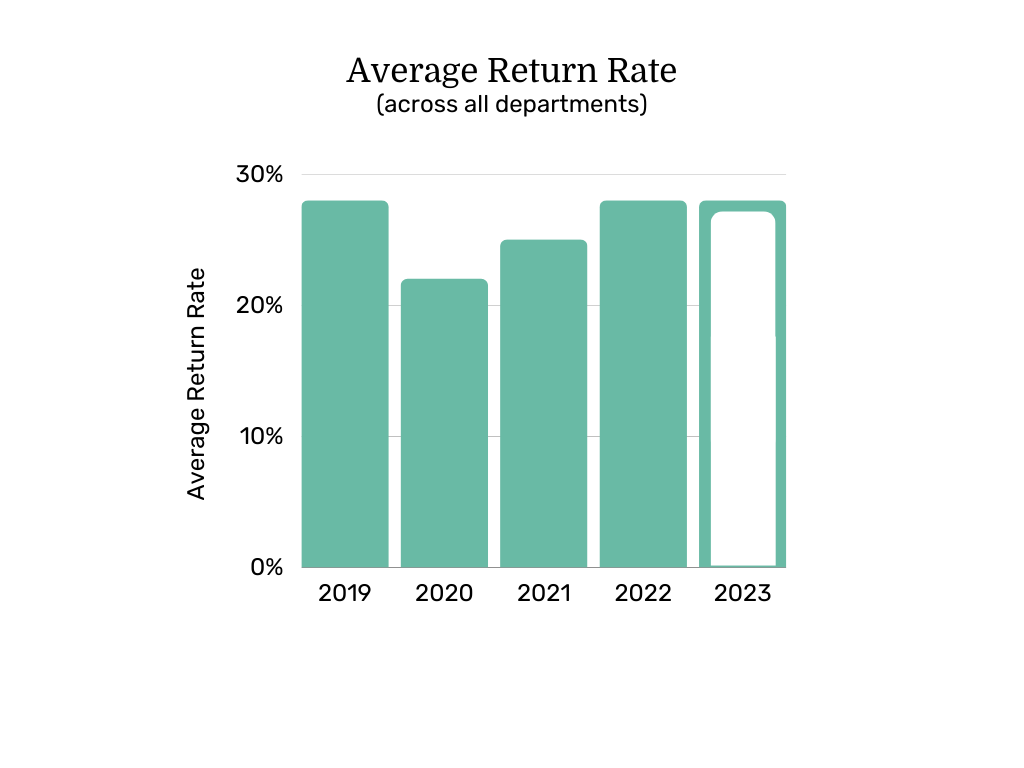

It’s also an ever growing cost, last year we saw return rates rising a huge 13% (3%pts) on 2021 rates. This means there were 270m more apparel returns in 2022 compared to 2021, and it’s not set to reduce in 2023. The cost of processing these returns alone will cost the industry £2.2bn (up by ~£1.2bn on 2021). This inefficiency will negatively impact EBIT margins by 3%.

What’s the reason for this rise in returns? Is it customer behavior or product/feature mix driving them? And what will they look like in 2023?

Here is a breakdown of our analysis on the increase in return rates in 2022 and what we expect to see over the coming year.

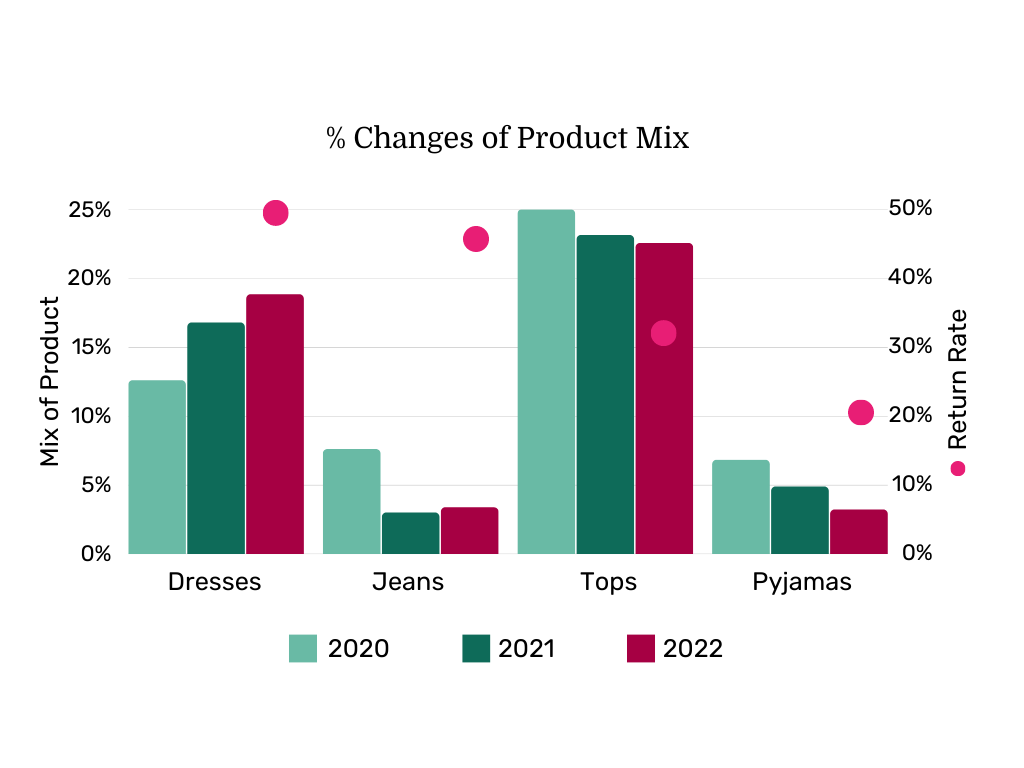

A ‘return rate heavy’ product mix

Part of this rise is due to a more “return rate heavy” product mix. Dresses, Tops and Jeans/Bottoms are typically the 3 largest categories. Dresses have increased by 12% to 19% of the product mix and jeans have increased by 13%. They are also the categories with the highest return rates.

On the other hand, there has also been a decrease in products with a lower return rate. Tops have a return rate of 32.2% on average and decreased by 2.5% of the product mix. Pajamas have a return rate of just 20.4% on average and decreased by a huge 34% of the product mix.

The chart below shows the changes in product mix and the corresponding return rates for these categories.

This product mix change has increased the return rate by 0.62%.

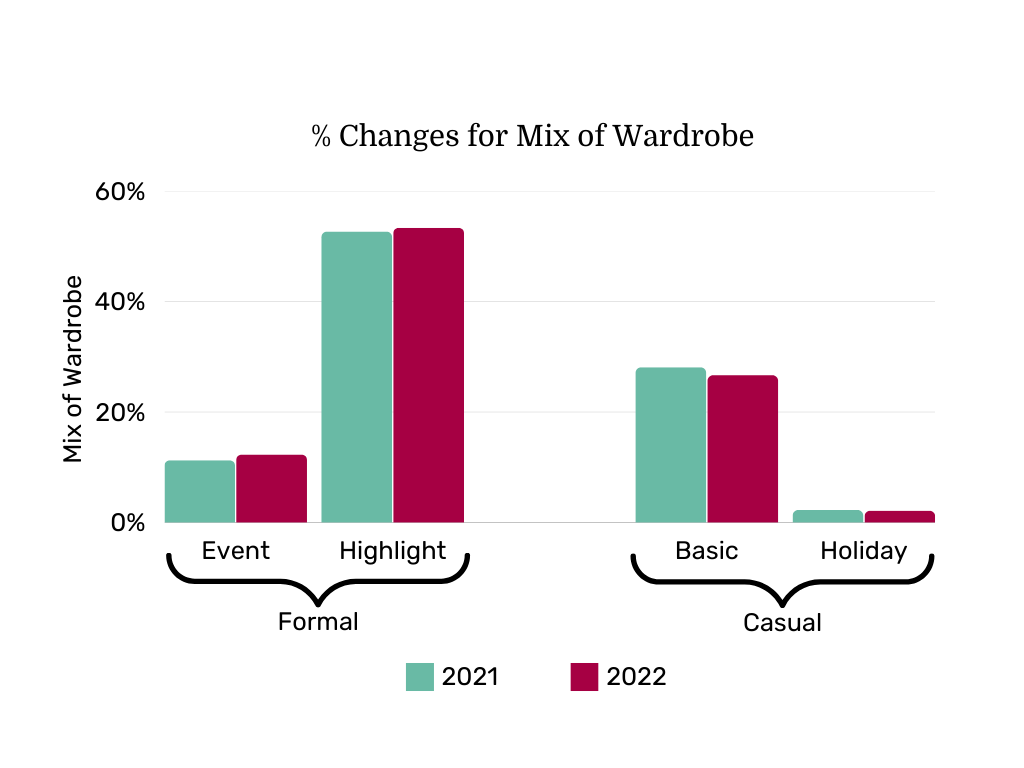

Formalization of fashion

When you dig deeper into each category you can see that there is a move to a more formal wardrobe which has a higher return rate. Event pieces have increased by 1.03% of mix of wardrobe and highlight pieces have increased by 0.7%. The casualization of fashion that we have seen over the last few years is now decreasing in terms of mix of wardrobe. Basic and holiday pieces have decreased by 1.43% and 0.13% respectively.

The chart below illustrates the changes of wardrobe type.

Return rates within each category are increasing. Increasing the return rate by 2.75%.

The combination of product mix change and the formalization of fashion therefore gives an overall increase of 3.22% in 2022.

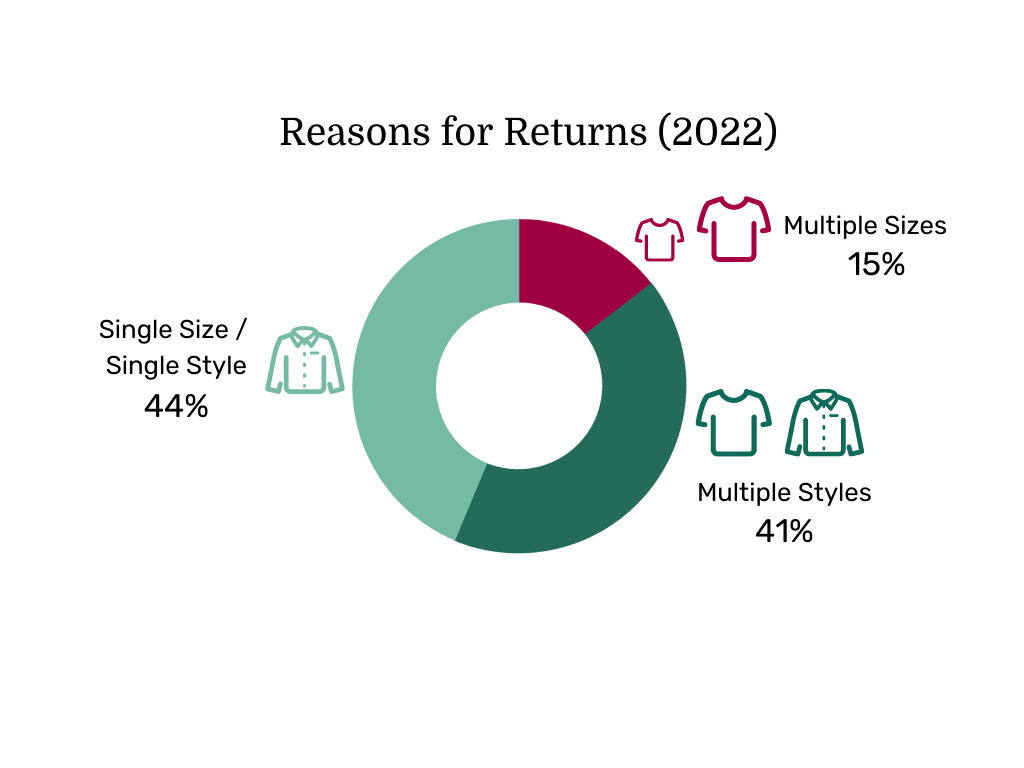

Multiple Style Options is the Big Growth Area in Return Reasons

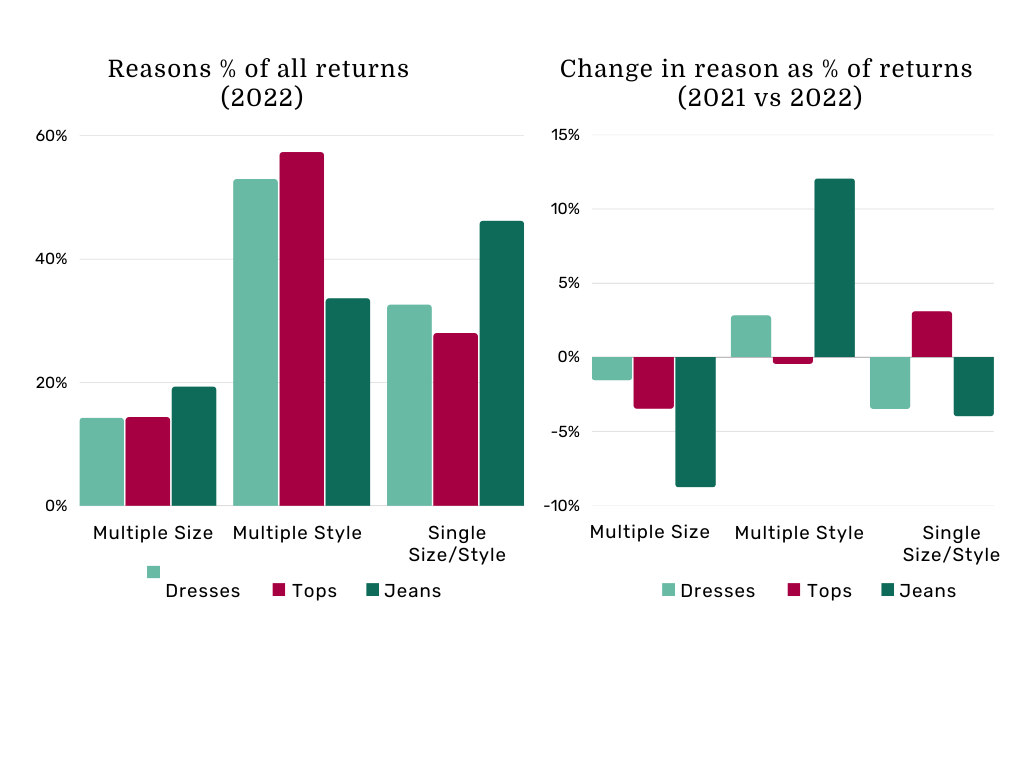

Rather than rely on reason codes (that are less accurate), it’s more helpful to use a data-driven methodology to get a sense of the reason for garments being returned. Split the returns into 3 categories:

- Size is the issue: When the same customer buys the same product in more than 1 size over any number of orders within a year

- Style is the issue: When the same customer buys multiple options of the same category within the same order, having removed multiple size orders

- A single size and single category product

Typically the percentage of online apparel returns reasons breaks down as follows:

Although, those reasons do vary by garment category. There has been a minimal change in reasons for returning tops but the percentage reason for style has significantly increased for both dresses and jeans, contributing to the high return rate.

Multiple size options have decreased across all categories suggesting people have become more comfortable with shopping online and know their size. Returns will be due to product specific reasons instead. The charts below show this breakdown:

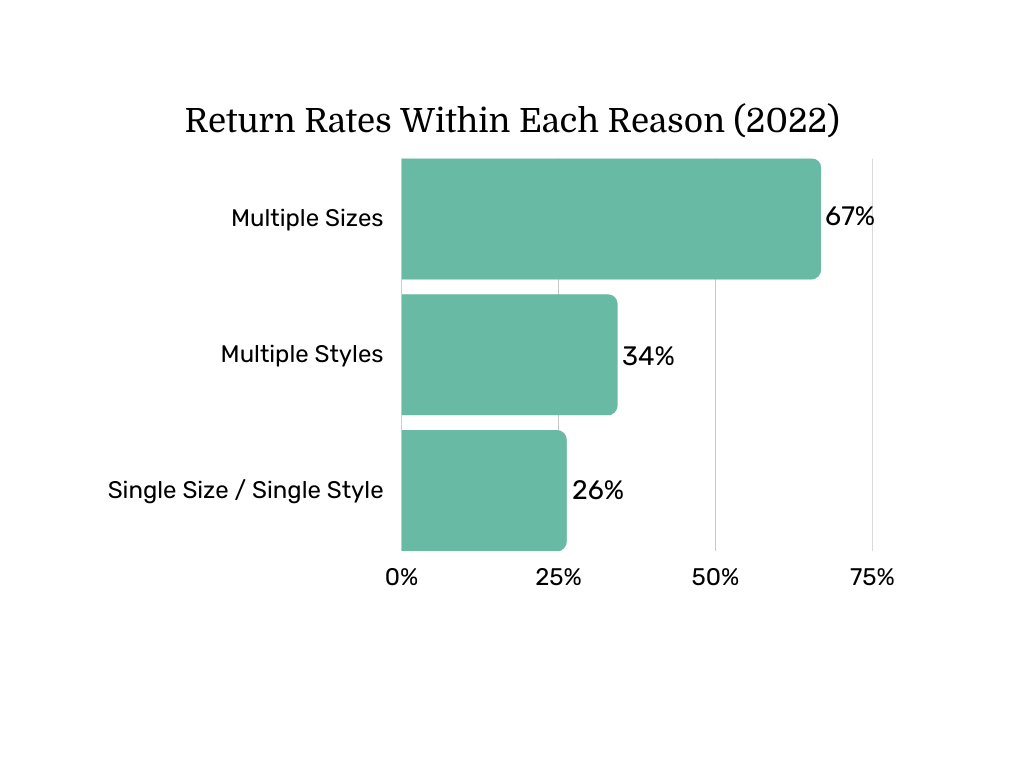

When you look at the return rates within each reason category, you typically see the below:

There has been an 8% decrease in multiple size return rate and increases of 11% and 13% for multiple style return rates and single size / single style returns respectively.

When return rates for any multiple size purchase are at 67%, it suggests that the size wasn’t the issue but that the product wasn’t right in any case.

The impact of charging for returns

Over the course of 2022, more and more retailers were announcing their surge in return rates and a change in strategy to try and reduce them. Notably, Zara reported they’re going to start charging for online returns.

This will be beneficial for retailers in a time when they really need to protect their profits and with the average cost to process returns increasing by 8% in 2022 due to increased delivery costs from high inflation. Presuming all else stays the same, if retailers charge for 75% of return costs, margins will increase on average 3%.

However, recent data from Optoro showed that 60% of surveyed consumers opted to not shop with brands that didn’t offer free returns. Therefore, multi brand retailers need to be careful of charging for returns as it might lead consumers to go direct to site.

Overall Return Rates

So due to the ‘return rate heavy’ product mix, the formalization of fashion, and people buying multiple styles means that return rates for 2022 vs 2021 are up a huge 13% (3%pts) with the average number of returns per person increasing by 11% from 2021.

After a few years of external factors significantly impacting fashion retail, it’s very hard to predict what will happen next, especially with the looming increasing inflation. However, we predict that return rates in 2023 will be in line with 2022 due to an increase in return rates as consumers face the cost of living crisis and become more cautious with what items they keep but also a decrease in return rates through an increase in retailers charging for returns.

What Can Fashion Retail Bosses Do About it

-

1. Make someone in the c-suite responsible for returns: Whilst most fashion retailers understand the impact their returns experience can have on customer loyalty and their digital profit, it always amazes us that no one person in the business owns this metric.

-

2. Take the time to analyze the data to state the problem (rather than trying to solve a problem you assume exists): Most retailers assume that confusing sizing is the core reason for returns (and, to be honest, so did we when we started!). But a deeper look at the data tells a very different story of people moving the changing room to their bedroom. And it makes sense - 70-80% of any retailer’s revenue comes from their top 20-30% of customers and they typically know their size. Those heavier customers are also responsible for the bulk of the returns, so they are more likely to be other reasons than size.

-

3. Only recommend items that customers are likely to keep: This is a quicker and easier way to reduce returns (and increase profitability). Turn the returns problem on its head and embrace the multiple style purchases, encouraging customers to have fun trying stuff on at home, but make sure what they have selected are items that they are going to love. Put the clothes in front of them that they are going to find difficult to resist keeping.

Prediction for 2023

-

1. Increase in Sale & Resale Shoppers: As inflationary pressures set in, and more retailers provide second hand resale, consumers are more likely to come in search of a bargain. Typically, for people who shop in sales, the return rate is lower.

-

2. Return rates will be in line with 2022: With a combination of more retailers charging for returns, inflation and the cost of living on the rise we predict return rates will stay in line with 2022. However, there is a possibility of a return rate decrease depending on how customers trade up or down their clothing choices.

-

3. Category specific Shifts:

-

- Basics and timeless pieces will increase as a % of mix (as opposed to trend items). These items have a higher return rate.

-

- Pyjamas and loungewear will slump back to 2019 levels.

We’ve got a dedicated guide on how you can leverage the data you hold to reduce return rates and improve operating margin. Follow the link below to download!