Why fashion-specific customer experiences can drive profitability and loyalty in-store.

The pace of transformation in the fashion industry has been accelerating over the last few decades. After the successes of Amazon selling books and electronics online, the first wave of change came in the form of a channel shift where retailers began to sell online as well as offline.

After years of fashion retailers selling successfully via their online stores, the second, current wave is to deliver hyper-curated, hyper-personalized services to customers.

However, as retailers have begun this journey there is an increasing understanding that fashion behaves very differently to other categories such as books, electronics or travel. As discussed in Harvard Business Review’s ‘How Retail Changes When Algorithms Curate Everything We Buy’, ‘differences between travel and retail curators make direct comparisons difficult…developing these engines for retail will probably be harder than it has been for travel’.

Over the last decade, online retail has grown quickly and now represents around 20% of all retail purchases in the UK. Recently, however, the rate of growth has slowed (lowest ever growth rates were recorded in the first half of 2019) and analysts’ forecasts for 2030 range anywhere from just 30% to 50%. It isn’t time to panic but it is time to think about how online and offline channels should work together to create the best service for the customer.

Next Plc, one of the UK’s largest retailers, understands the value of bricks and mortar stores in the overall customer proposition. Having secured rent reductions for some of its stores the company is due to add 100,000 sq ft of space compared to an earlier estimate of 50,000 sq ft. Next CEO Simon Wolfson says, “Returns are a central part of our online service and 82% of returns come back through our stores. It is counter-intuitive, but the fact is stores have become an important part of our online service”. A bricks and mortar presence on the high street is not just about enabling the online business (and lowering the costs of returns and distribution) but also a way to offer a richer shopping experience to its customers.

Online is on its way to personalising experiences for every customer. The store, however, is lagging, which is unusual, since forecasts say most of the fashion shopping journey will continue to take place in physical environments. Retailers should be offering an individual level of in-store hyper-personalization if they are to stay relevant and create experiences that build unique, long-term relationships with customers.

Guiding the Shopper

To succeed at every touchpoint (not just online) a customer’s experience with their favourite brands needs to be more intelligent and more individual, and yet there is currently very little activity focussed on individualising the store experience.

Having said this, several forward-thinking brands are trying tactical projects. Amazon and McKinsey have opened pop up stores and malls, whilst Nike and Reformation are good examples of brands that have been experimenting with more permanent concept stores centered around customer experiences.

Some retailers are taking a different tactic by repurposing space (Next Plc), whilst others (ASOS and Zalando) are starting to use machine learning to optimize inventory stock and size levels.

However, regardless of this progress, no one is taking the obvious step of using personalization to guide the shopper through their physical journey despite all the technology being in place to be able to do so.

Imagine the following scenario…

You are looking for a dress to wear to a wedding. You have started to browse at home on your mobile but prefer to shop in-store. As you walk into your favourite retailer, your profile is recognised and used to look up the most relevant dresses available in your size, in that store right now.

A tailored list of recommendations appears on your phone, ordered by recommended strength. You choose three to try on, and while you continue to browse, an in-store assistant is fetching your sizes out of the stock room and preparing a changing room for you.

You spot a few other items you like whilst walking around the store and want to know their suitability for you. You scan their barcodes and the product is recognised by your digital AI wardrobe assistant who gives you feedback on versatility and suitability based on what you already own.

In the changing room, you can’t decide between two dresses. You want to choose the one which works best with the shoes and bag you bought last month. You simply scan the barcode and the AI visualizes the complete outfit for you, together with multiple other outfit options with items from your wardrobe.

But the personalization doesn’t stop here. After you have left the store paying using your mobile Pay & Go, without the need to queue at the checkout, the personalization continues.

Ideas about how to wear your dress for different occasions and how to style your dress with new complementary items when they arrive new at your nearest store (or online) are simple ways to continue to personalize the experiences for every customer at scale.

Retailers need to create experiences and services that customers want to use and that add value to their shopping journey. If these services reflect the customer’s aspirations, then they will be more willing to share their data in return, particularly if it enables the retailer to be more efficient.

The integrated shopping experience described above is a great example of what the future of retail could look like, but there are certain unique factors found in the fashion industry that make achieving this more challenging than in other industries.

Problems and Nuances Specific to Fashion

1) Sparsity of Data

Retailers have a lot of data, but on a per-customer basis, it is typically very sparse. 60-70% of a retailer’s customers only buy 1-2 items with that retailer each year but the same customers are buying 30-40 items across up to 15 retailers. This means that each retailer typically only has access to a small portion of its customers’ shopping behavior.

If retailers are trying to build customer experiences based on less than 5-10% of each customer’s behavior, those experiences that can be developed and delivered to each customer will be limited in both its success and scope.

2) The Way We Shop for Fashion is Different

Most generic personalization vendors completely miss that fashion is a complex and emotional purchase and don’t understand the nuances that make it different. Unlike other categories, clothes are typically bought to go with other items the customer already owns.

A recent Dressipi survey sent to over 2,000 people, showed that 73% said it was important that outfit recommendations included a mix of items they owned as well as new ones, with an extra 10% wanting recommendations drawn only from items they already owned.

3) Fashion is Dynamic

The fashion industry is dynamic on many levels, therefore the experiences delivered to the end consumer need to anticipate and adapt to whatever reaction customers may have to changes brought about by this dynamism.

Some examples include:

-

Customer Changes (shape, preferences, lifestyle)

It is important to keep up with customers’ changing needs and expectations. For example, understanding that a customer has just started a new job that requires a less formal more creative wardrobe.

-

Industry Changes (trend, seasonality)

Seasonality and the weather hugely impact what people prefer, buy and wear at different times of the year. Trend followers are more fickle in their preferences, meaning a customer’s trend propensity needs to be understood.

-

Retailer Changes (inventory and stock levels)

Retailers add new items regularly (with increasing frequency for fast fashion retailers). Unlike other categories, clothes are only available to purchase for 3-6 months. This short lifetime means that each item only has a short period in which to collect data about it, resulting in further data sparsity.

How to Overcome These Problems

Unless a retailer can build this domain expertise and some appreciation of these nuances into their chosen technology/AI they will struggle to deliver personalization to the fashion customer.

1) Get Better Quality Data

-

On Customers

Allow customers to provide more information about themselves, constantly give feedback and the opportunity to create a richer profile and set explicit preferences around garments and features.

Have an understanding that with fashion, customer preferences evolve. Some of that data can be explicit, such as their body shape (if they start buying a different size then they will have likely changed shape) and some can be implicit such as what trends they like.

-

On Products

Retailers need a more accurate way to enrich their garment data to ensure the right breadth, depth and consistency of data. Typically, this will describe the garment's versatility, how it might be worn and what it should be worn with, all in the context of purchases already made by the customer. The more detailed the data, the richer the experience.

2) Supplement the Gaps Left by Data Sparsity with Expert Domain Knowledge

Due to the sparsity of data and because of the nuances specific to the fashion domain, a combination of fashion stylists and technology will, for the foreseeable future, outperform any purely AI and big data solution. Technology is a key tool, but the human element is still very important. Fashion stylists can fill in the necessary gaps that technology misses.

Having fashion experts involved ensures the understanding of the nuances of the industry. They must work very closely with tech and data team to build algorithms that take into account the fashion-specific information explained previously.

Leading the Way in Creating Hyper-Personalized Experiences

Dressipi is currently working with some of the UK and Europe’s biggest retailers on their long-term strategies to drive profitability and customer loyalty by redefining the shopping experience as we know it.

By enabling a better understanding of a retailer’s products and customers through a fashion lens, Dressipi can help deliver truly unique experiences both online and in-store regardless of the chosen technology and completely in line with the brand’s DNA.

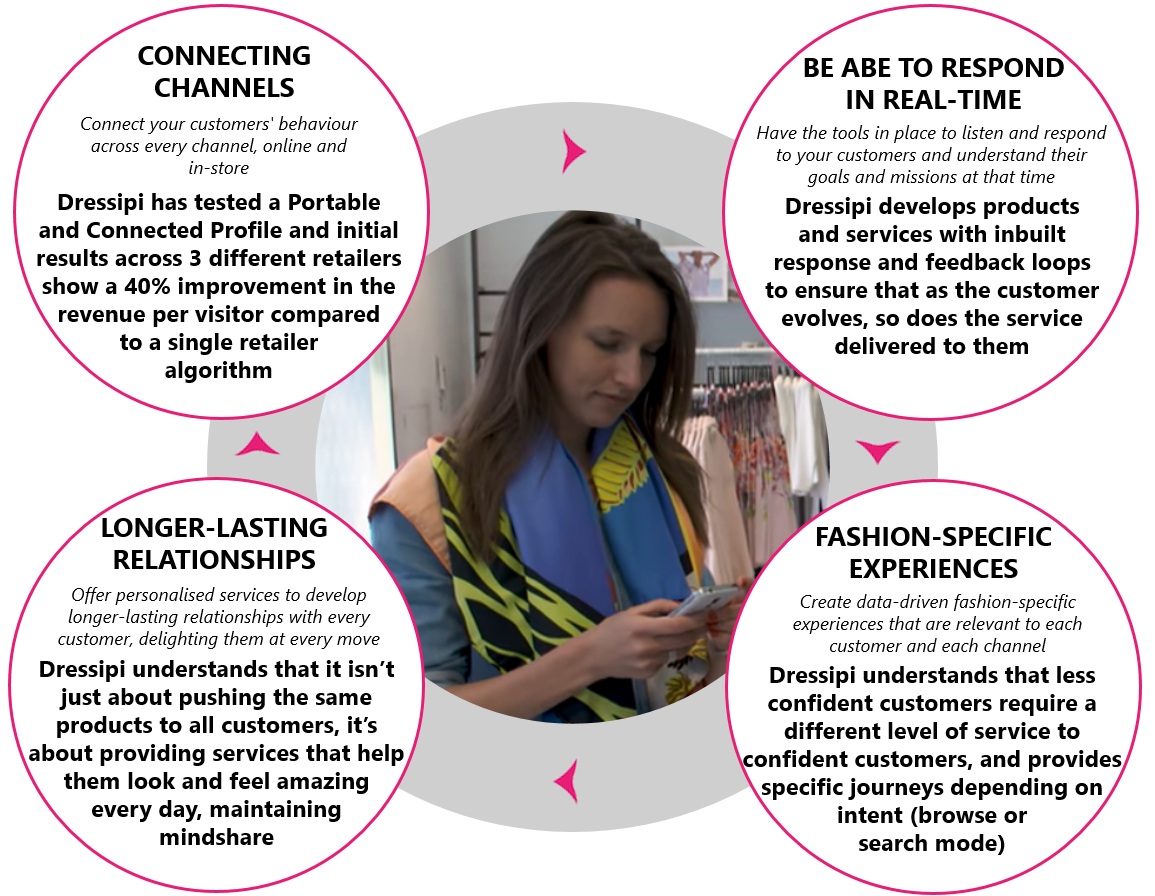

From years of working closely with retailers, Dressipi knows that customers want specific experiences that change depending on what their intent is at that moment in time (browsing vs looking for something specific). Therefore, services should allow customers to express their intent for that visit and allow this to be persistent across channels.

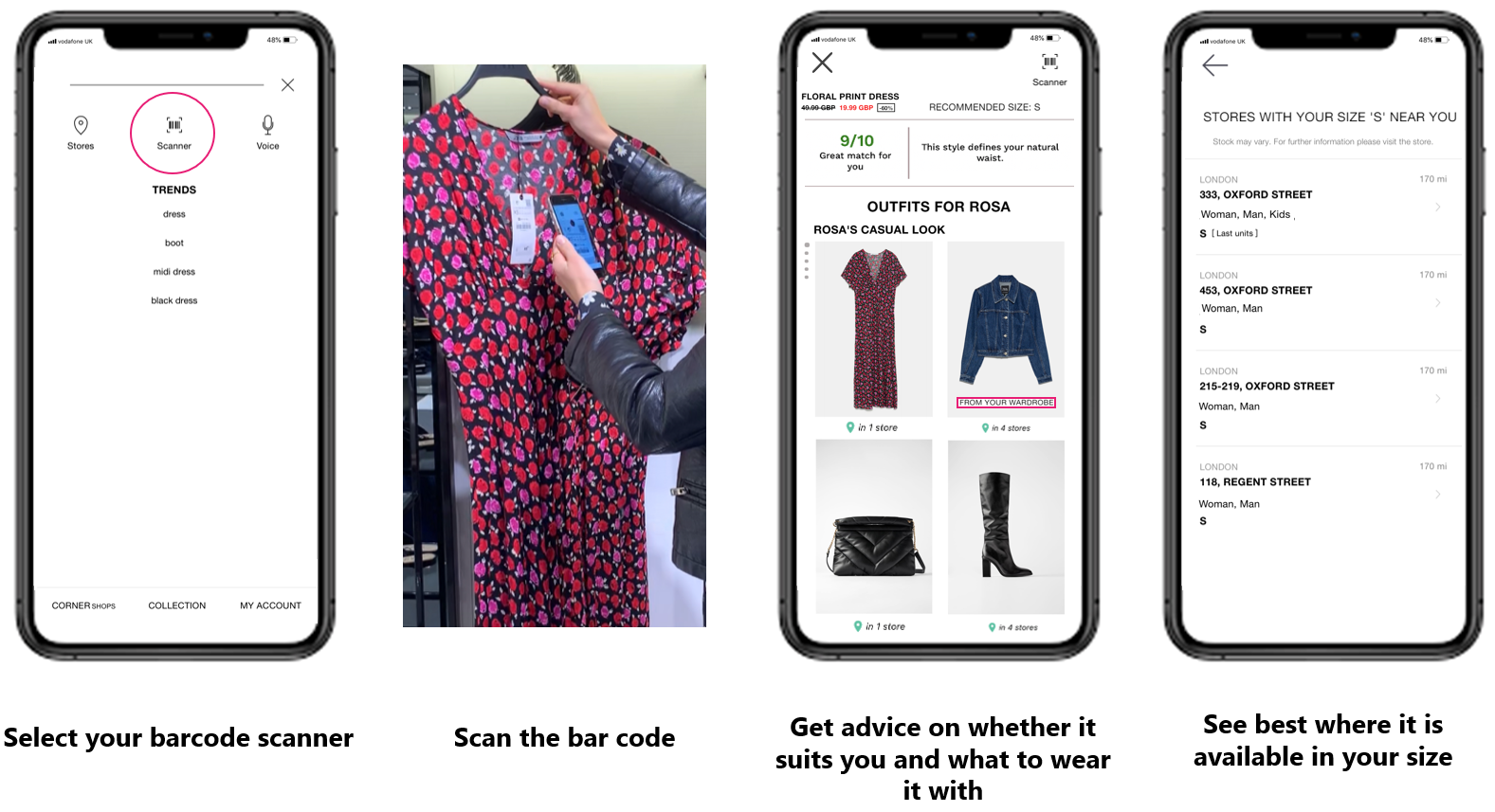

For example, some retail stores currently allow their customers to scan a barcode, but the experience is disappointing and far from innovative. The output is the same as they would get online - a customer gets redirected to that garment’s PDP (Product Description Page) with the standard variety of product images at different angles, sizes in stock, garment composition and care etc.

When a customer is in a store their requirements are very different. For a start, they can see and feel the garment, so typically the information provided by the PDP is not very useful. They’ll typically be looking for information on one of the following:

-

Whether that item suits them and whether it is appropriate for the purpose they have in mind

-

How they should wear it (with clothes they already own or new items)

-

What size they should try on and if that isn’t available in that store, if there’s another store nearby with availability, or

-

Other items that are similar if that one isn’t quite right

As well as being delivered directly through an app or mobile site, the data can also be linked up to clienteling apps for store staff to use. Dressipi’s API’s can be extended to create a scalable personal styling service that enables a 1-2-1 conversation with every customer.

These are a couple of examples of how Dressipi can deliver in-store experiences unlike anyone else, but there are many other ways retailers can leverage this deep data understanding to create hyper-curated experiences that mimic how people shop in real life, delivering an extra 15-20% uplift in revenues.

Dressipi believes there are 4 key steps to delivering successful experiences within fashion retail:

Conclusion

At Dressipi we have always maintained that good retailing is made up of three key pillars:

1) Great products

2) Great customer service

3) The right price point

Technology can supercharge all of those efforts but the fundamentals still hold true.

As fashion becomes more global and competitive, brand positioning and DNA becomes increasingly important. Stores can be a vital component of that success, demonstrating what each brand stands for, but to do that, the role of the store needs to be redefined to work seamlessly alongside other channels.

We know from years of experience that personalization is not a one-off project. Retailers should be working with partners that will enable experiences customers need so they are more willing to share their data in return. Furthermore, technology now allows retailers to put excellent service back into stores at a fraction of the cost.

By focusing on servicing the customer, retailers will gain so much more data than they would otherwise, meaning that they will be in a significantly better position to develop better products for their customers at the right price, every time.

Sources

- Harvard Business Review ‘How Retail Changes When Algorithms Curate Everything We Buy’

- Parcel Hero, ‘2030: The Death of the High Street’

- The Guardian, ‘Half of UK retail sales will be online within 10 years, report predicts’

- The Financial Times, ‘Next accelerates store openings after rent cuts’